Understand the difference between standard and raw spread accounts, how brokers earn through spreads, swaps, and commissions, and how to choose the right account type for your trading style.

Standard vs. Raw Account: Does It Really Matter?

Yes, it does. And if you’re serious about trading, you

should know exactly how your broker earns because it directly affects

your trades.

Before we get into which account type to choose, let’s break down how brokers make money:

How Brokers Earn from Your Trading

1. Spread

The difference between the bid and ask price. This is the

most common way brokers earn, especially in standard accounts. You don’t

see a separate charge, but it’s already included in the price.

Example: If EUR/USD has a 1.2 pip spread, and you buy at

1.1000, you’re already in a -1.2 pip position when you enter the trade.

2. Swap (Overnight Fee)

A small fee (positive or negative) is charged if you hold

trades overnight. This is based on the interest rate differential of the

currency pairs.

Traders who hold positions for multiple days or weeks often

pay or earn swaps depending on the pair and trade direction.

3. Commission

This is a direct charge per trade, usually applied to raw

or ECN accounts. Instead of marking up the spread, the broker charges a

flat fee per lot.

Example: A raw account might have near-zero spreads but

charge $6–$7 per round-turn lot.

So Why Does This Matter

When Choosing an Account?

Because your account type determines how you pay fees,

and that impacts your overall profitability.

Some traders become overly cautious when they see wider

spreads in a standard account. They feel like brokers are “eating” into their

trades, even if they’re only trading small positions. But here’s the truth:

Regardless of the account you choose, fees are

unavoidable.

Forex brokers are businesses. They provide you with access to global liquidity, tech infrastructure, platforms like MetaTrader, and customer support, all of which are not free to run. Whether it’s via spreads, commission, or

swaps, they must earn.

The key is understanding which account type suits your strategy and how to minimize costs by choosing brokers with tighter spreads or lower commissions.

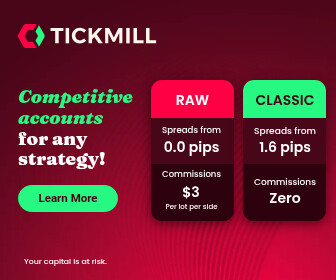

Standard Account vs. Raw Account

Let’s compare these two popular account types:

|

Feature |

Standard Account |

Raw Spread Account (ECN) |

|

Spreads

|

Marked-up

(1.0–2.0 pips avg.) |

Near-zero

(0.0–0.2 typical) |

|

Commission |

None

|

Charged per

lot (e.g., $6/lot) |

|

Cost

Visibility |

Hidden in the

spread |

Clearly shown

per trade |

|

Best For |

Swing,

position traders |

Scalpers,

high-frequency traders |

|

Trader

Behavior |

Prefers

simplicity |

Prefers

precision |

Traders Who Prefer Raw Accounts

• They set precise Stop Loss (SL) and Take Profit (TP) levels

• They want ultra-tight entries and exits

• They don’t mind seeing commission charges in MetaTrader journals

Traders Who Prefer Standard Accounts

• They are more comfortable with fewer line-item costs

• They are okay adjusting SL/TP to account for spreads

• They do fewer trades with bigger TP/SL margins

The Bottom Line: Broker

Will Profit, And That’s Fine

Yes, your broker earns from you trading. You can complain

about fees, but at the end of the day:

• They maintain server access and liquidity

• They handle order routing and support

So instead of feeling like you’re being “robbed,” focus on

improving your trading skills so you can adapt regardless of account type.

Final Tips Before You

Choose:

2. Check broker conditions – Some brokers offer tighter spreads and lower commission combos. Look around.

3. Test both accounts – Open a demo or micro live account on both and feel the difference.

4. Read the fine print – Some brokers apply commissions “per side,” others “per round turn.” Always check.

Real Talk:

Looking for an account with zero spread, zero commission,

and zero swap is just unrealistic. Trading isn’t free, and neither is

access to global markets.

The smart move? Choose the broker and account type that matches your strategy and offers transparent, fair pricing.